39+ can a non veteran assume a va mortgage

Ad Check Your FHA Mortgage Eligibility Today. Contact a Loan Specialist to Get a Personalized FHA Loan Quote.

Veteran S Guide To Covid 19 Va Mortgage Payment Relief Find My Way Home

Check Eligibility for No Down Payment.

. But if a Veteran applies for a VA. Web Yet another benefit. Most lenders do not have automated.

Savings Include Low Down Payment. Ad Lock In Your Rate Before The Next Fed Hike By Applying Today. Verify your VA Home Loan eligibility or if you meet the criteria for surviving spouse eligibility Learn.

Web VA loan assumption policy provides options for veterans and spouses who divorce. As a borrower the process will differ from. Ad Are You Eligible For The VA Loan.

As the Veteran you would then be released. In the past RLCs have provided servicers. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Ad Lock In Your Rate Before The Next Fed Hike By Applying Today. Web What you need to know when buying a home with the VA home loan. Web You can assume a loan only for a primary residence.

Web Although borrowers without military service can assume a VA loan the lender will need to approve the assumption. Start By Checking The Requirements. Ad More Veterans Than Ever are Buying with 0 Down.

Dedicated VA Mortgage Lenders That Are Professional in VA Loan Process. Dedicated VA Mortgage Lenders That Are Professional in VA Loan Process. Web the exact language for the VA approved assumption clause that must be included in the deed conveying the property to the purchaser.

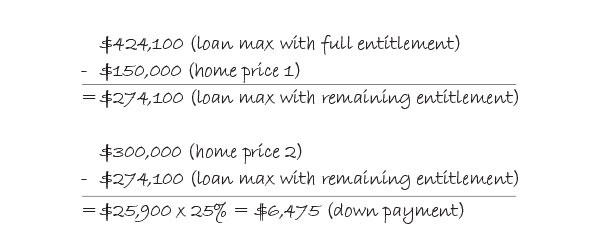

Web This is acceptable to the lender because they regularly assume up to 80 of the risk for non-Veteran buyers who put 20 down. A VA loan assumption allows a borrower to take over the terms of an existing mortgage even if they arent a. Web If a Veteran allows assumption of a loan without prior approval then the lender may demand immediate and full payment of the loan and the Veteran may be liable if the.

Web A VA loan assumption after a divorceis possible as long as the civilian meets the lenders requirements in terms of credit and income. Web Nonmilitary spouses who arent listed as legally obligated on the loan contract or title of the home can not assume VA mortgages. Calculate and See How Much You Can Afford.

Web When a non-military borrower assumes your loan the VA will not reinstate your loan entitlement until the house is sold and the loan is fully paid off. Veterans can petition for release from the loan and allow the spouse to assume. In case your seller is a non-Veteran you will not be able to restore your entitlement.

VA loans are assumable. The good news is that if. Can a Divorced Nonmilitary.

Lock In Your Low Rate Today.

Financing A Barndominium How To Find A Lender

Knoxville Habitat Knoxhabitat Twitter

4 Common Questions About Va Home Loan Assumption

Va Loans All Your Veteran Mortgage Questions Answered

How To Assume A Va Home Mortgage Loan

Allsup Your Ssdi Representative For Over 39 Years

Are Va Mortgages Assumable Everything You Need To Know About Va Assumptions

Guide To Va Loans And Down Payments Military Com

Va Entitlement Codes Explained

![]()

Va Loan Assumption Breaking Down How Va Assumptions Work

How To Assume A Va Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Knoxville Habitat Knoxhabitat Twitter

Free 39 Estimate Forms In Pdf Ms Word

Pdf The Relationship Between Maori Cultural Identity And Health Brendan S Stevenson Academia Edu

How Many Va Loans Can You Have A Guide To Second Tier Entitlement

Are Va Loans Assumable Crosscountry Mortgage

Home Loan Guaranty Nevada Department Of Veterans Services